How To Set Up A Bookmakers

Setting up Bookmakers

The process of bookmaker registration can be done any number of different ways. Most people want to approach it clinically and split their money evenly across 6, 10, or 20 bookmakers they have chosen and registered with ahead of time. Funding any number of books evenly is usually not advisable because not all bookmakers are created equal; you will want to have more money in the key books (like Pinnacle or Betfair for example). The general approach of pre-picking books, registering and funding them all ahead of time will work, but I do not personally think it is the best approach.

I now recommend a more systematic approach to bookmaker registration and funding. When I started arbitrage trading the above approach was recommended to me, followed by a few weeks of paper trading to get used to the bookmakers I had registered with. My new method does not require pre-selection of bookmakers, and it sort of works paper trading into the process, so that you never have to give up a few weeks of trading to practice – the practice is done while setting up.

Overview

The basic idea is to choose your bookmakers 1 or 2 at a time based on real arbs presented to you by your alert service. You slowly and systematically open the accounts and fund them appropriately, ensuring bonuses are claimed, while actively placing a real arb. As most arbs only last a few minutes and this process may take up to 30 minutes, the objective is clearly not to rush and get the arb, but rather to slowly and carefully get all of the conditions set up correctly, and then still possibly get an arb at the end.

The point of this process is to find books which have clearly demonstrated that they do produce real arbs, and to then systematically fund these good books with an appropriate amount of money to take the best advantage of any sign up bonus on offer. The registration process should never be rushed in any way.

Set Up Bookmarks Firefox

Registrations should be continued until about 75% of your bankroll has been deposited. The remaining 25% will then be used to fund active bookmakers as they are emptied. New bookmakers will be only be opened as old bookmakers are made useless (by being limited, or by eventually showing that they are less profitable than other books), or as your bankroll increases so as to be able to fund more books at one time.

The Detailed Process

You have a few thousand dollars in your E-Wallet account, you are not registered at any bookmakers but you have an alert service running (either trial or your chosen alert service). The alert service finds a 1% arb between two bookmakers:

First, are these bookmakers worth dealing with?

Go to SureBetBookies.com and bring up the bookmaker’s details. Are they of a rating you feel comfortable with? Do they accept your method of deposit? Do they offer free deposit and withdrawal? Is there any user feedback indicating that they may not be honorable in their dealings? If everything looks OK, click on the link(s) to the bookmaker(s)*.

Most betting companies will require you fill out an online form beforehand. Each betting company comes with its own unique guidelines commission rates etc. Read also: How to Become Bet9ja Agent in Nigeria. Finance needed for Betting Shop In Nigeria. Conservatively, you will need between 250,000 to 400,000 to set up, depending on your location.

Second, is the arb still there?

- Quick step by step guide. To sign up for a Betfred account, follow this linkto their homepage. Click the green “Claim Now” button and this will allow to register your and claim the bet £10, get £30 in free bets. Fill in the registration form with the correct information.

- Several examples have shown that a bookie set up shop, collected a significant amount of deposits and then used absurd excuses, not to payout. The next step for the brains behind that scheme was to set up another betting site and go all over again. Therefore, we always perform a background check on the management team of the latest betting sites.

- Commission = (1 – (1 / 1.042). 100%. Commission = (1 – 0.96). 100%. Commission = 4%. So in this example, for every £100 that you bet, you are paying an average of £4 to the bookmaker. Or in other words, at a commission rate of 4%, you would be offered odds of 1.92 on a coin toss.

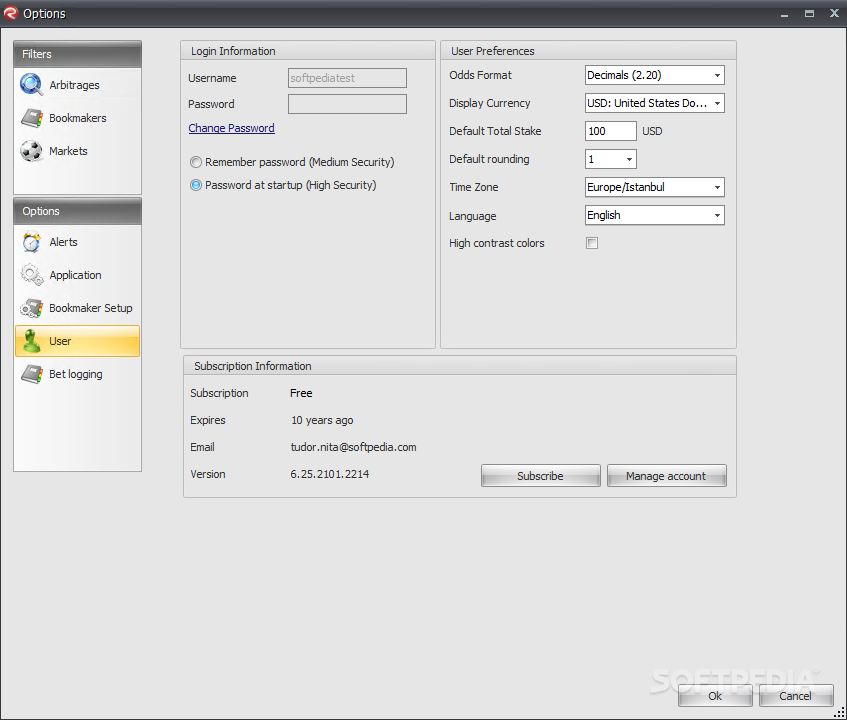

- Once you have signed up to an online bookmaker you will need to know how to set up a betting account. This is to make the user interface work for you and provide the best user experience possible. If you haven’t already signed for a betting account yet, please visit this guide on opening a betting account. Having your online betting account set up to work for you is extremely important especially if you are in-play betting.

Navigate your way to the sport in question and check to see if the arb is still there. If the odds are still available as reported by your alert service, also check to make sure all other relevant details are correct (point spread, handicap margin etc), and then also check to make sure there are no rule mismatches – SureBetBookies should still be open so if the arb is one on tennis, NHL or Baseball you will be able to see if the bookmakers in question have different rules very easily.

Third, are there any sign-up bonuses?

The bonus offers should be obvious, but some bookmakers seem to hide their sign up bonuses (not sure why!). Look on the home page of the bookmaker – look for 'Promotions', 'Bonuses' or any large percentage signs – and click on them to get more information. Thoroughly read the terms and conditions for the bonuses. Again, every bookmaker varies greatly on this point, some will have complex legalese saturated terms and conditions, others will have 3 dot points: whatever rules they tell you, heed them. Write them down in your trading spreadsheet if you must, because these are the rules by which you must play.

For more information, see:

Fourth, register.

Registration is usually pretty painless, just fill in your details – make sure you are using the same email address as you are using for your Moneybookers and/or Neteller account. Some bookmakers will require you to provide scanned ID at one stage or another (not usually up front, often before your first withdrawal, or else simply within a period of time), so you will need to have some ID available for scanning, and often utility bills with your address on them will be required also, so don’t try to use a fake address or name or anything like that.

Fifth, deposit money.

Before taking this step, check to see if the arb is still there. If not, it may be worth waiting for the next arb before you deposit. If the sign up bonus has time limits on though, then you may need to deposit anyway, or if the bonus is incentive enough on its own, then it may still be worth depositing anyway.

When deciding how much to deposit, the first consideration is the bonus – try to take full advantage of the bonus at least. If the bonus is a small volume high percentage one, then perhaps deposit twice as much as is required to claim the full bonus. You don’t want to look like you have only created the account to claim the bonus, so try to avoid depositing exactly the right amount to receive the whole bonus and nothing else. If the bookmaker has a small percentage large volume bonus (say 10% of deposit up to $500 bonus for example), then you will need to decide whether your bankroll can afford having that much money ($5000) in one bookmaker or not, and more importantly, whether this bookmaker in particular will be worth having that much money in it. If you are working with a small bankroll, then you may want to only deposit a smaller normal amount (just a few hundred) and accept that you can't get the whole bonus, or you might want to leave this bookmaker until later when you have a larger bankroll and are better able to take full advantage of the bonus.

Exactly how much to deposit is something which you have to decide upon from bookmaker to bookmaker. As indicated above, your considerations need to be your bankroll size, the deposit required to claim the bonus, the regularity this bookmaker is involved with arbs, and the average max bet size of this bookmaker. The last think you want is to end up with 10-50% of your total bank roll stuck in one bookmaker which you never see any arbs at, or a bookmaker which will only let you bet $50 at a time.

And one final point to remember is that it is easy to deposit more money, while withdrawing money can be complicated by bonus rollover requirements, limited free withdrawals per month, no-play withdrawal fee, and ID requirements before withdrawal processing. So if in doubt, deposit a little less and top it up as you need to. Don't get your money stuck in a crap bookmaker.

Sixth, place the arb.

Don't get too excited, we're still going slow! Check both bookmakers have their money in them, then go to where the arb was – is it still there? Are you sure there is no rule mismatch? Check the rules at the bookmaker itself, these change occasionally so SureBetBookies can’t guarantee its details are always accurate – I find it is helpful to note the rules for various sports in my trading spreadsheet next to each bookmaker.

Are you sure the other details all line up to make this a genuine arb?

If yes, then enter your bet amounts (calculated either by your alert service, or by an arb calculator of your choice), and then submit each bet, one after the other. Which should you submit first? You should always submit the bet at the bookmaker with which you are most uncertain whether your bet will be accepted. Some bookmakers will not tell you the maximum stake until after you attempt to submit your bet, so you should always try to place this bet first. The reason is to avoid having one side of the arb submitted, and then submitting the second side only to find out it has a $7 bet limit on it when you need to place $500.

If at ANY time during this process the arb disappears, or you start to doubt the validity of the arb – STOP. Missing an arb will not cost you money; making a mistake will. More arbs will come. You are ALWAYS better off missing an arb completely, than you are risking money on a gamble in arb clothing.

Seventh, update your records/spreadsheet and repeat the process.

You now have a funded e-wallet or two, you have your alert service finding arbs for you, and you have two funded bookmakers, hopefully with a good legitimate arb in process. You should also hopefully have some bonus cash in both of those bookmakers which may or may not need special attention. You should have a spreadsheet (we have a template available for download here) tracking your bookmaker accounts and arb trades and it should be up to date with regards to your new bookmakers, and the arb you have placed. I recommended tracking everything that you can think of, no matter how inane it seems.

Once everything is updated, pick your next arb, and start the whole process over again. Keep doing this until you think you have enough bookmakers, or you have 75-85% of your bankroll deposited. Keep 15-25% free and ready to deposit as your active bookmakers run out of funds.

Epistemic status: This seems sufficiently basic that it seems like someone would already have developed a general theory, but I haven’t managed to find anything. If you know of anything like this please let me know.

Say you want to make some really good choices – you want your business to succeed, your marriage to flourish, and to beat your long-term rival in a chess game. Problem is, you’re not very good at making your own decisions.

The obvious thing is to ask some experts for help. But there’s two problems with this: First, who even are the relevant experts? In chess this is simple enough – just call up the top ten or so players by ELO rating – but who will you call for your business and marriage? MBAs and marriage counsellors claim to have relevant expertise, but there’s no good rigorous data to check how good they are. Second, what do we do when the experts disagree? And how do we get them to help us in the first place?

The classic solution for this is to set up a betting market. The good experts will gain influence, money, and confidence proportionate to how good they actually are, and the Efficient Market Hypothesis implies this will give us the best possible decisions (assuming there’s enough money in the market to make it worth the competent experts’ time). This solves the last two problems, but “just set up a betting market” is doing a lot of work on what we actually need to do here.

The classic example people give of a betting market is the stock market, but in practice they’re pretty different things. In the stock market, investors bet on how well publicly traded companies will do[1], and make money if they’re right[2][3]. In theory the thing that backs this all up is that companies have the ability to give dividends when they make profits, and that if you buy enough of a company you get the power to control it, but in practice this is all a Keynesian beauty contest. The values of betting markets, on the other hand, are backed by the fact that they pay out directly if you’re right.

But this distinction doesn’t really matter – there’s other things, like commodities, where trading pretty closely resembles direct bets on a belief. The bigger issue with the equivalence is that there’s only about 3500 publicly-traded stocks in the entire US market. For comparison, there’s about 10^40 possible chess positions, which is far more unmanageable, if you were to just do the simple thing of trying to evaluate how good the various positions are. Marriage and business decisions are even more multibranched.

Here’s one solution for chess: At each turn, set up a betting market on which move you’re most likely to win with. Once the market closes, you make the move that had the best odds. Everyone who bet on a different move gets their money back. Bets on your move are kept in the pot, and get their winnings (from the people who bet for the other player’s betting market) if you end up winning the game. This technically works – the bettors’ incentives are aligned with having you win[4], and there’s always a manageable number of options – but there’s a lot of friction. It takes a lot of moves for a bet to pay off, and it’s pretty risky (even if you’re completely sure what the best move in one position is, there’s about forty other moves that could ruin it for you). The time lag is particularly bad for the other examples – you can finish a chess game reasonably fast if you set a ten minute time limit on the betting market for each move, but it takes much longer to see if your business or marriage will succeed.

One possible solution to this is to set up a secondary market (which none of the people in the betting market can bet on) reflecting the general state of your success – Just a market on how likely you are to win the chess game, for chess, or just the stock price, for your business – and have the primary market pay out in proportion to how much your stock went up or down after you made your move. I can’t think of a reason this shouldn’t work well, so long as you can discretize your decisions, although it still has issues with being noisy and overcomplicated.

Another specific story: Scott recently (probably non-seriously) proposed the idea of ConTracked:

ConTracked: A proposed replacement for government contracting. For example, the state might issue a billion ConTracked tokens which have a base value of zero unless a decentralized court agrees that a bridge meeting certain specifications has been built over a certain river, in which case their value goes to $1 each. The state auctions its tokens to the highest bidder, presumably a bridge-building company. If the company builds the bridge, their tokens are worth $1 billion and they probably make a nice profit; if not, they might resell the tokens (at a heavily discounted price) to some other bridge-building company. If nobody builds the bridge, the government makes a tidy profit off the token sale and tries again. The goal is that instead of the government having to decide on a contractor (and probably get ripped off), it can let the market decide and put the risk entirely on the buyer.

How To Set Up An Online Bookmakers

This is, in principle, a pretty similar idea! We make a coin that relates to the underlying value (the probability that an infrastructure project will satisfy customers), and then let the contractor work on optimizing that. There’s a boring finance-y issue that makes this a potentially bad idea – it’s better to offload risk from contractors onto city governments – but this makes a real attempt to address the other main issue common to contracting out infrastructure projects: They’re a monopsony (the government is the only customer for most infrastructure projects) with unclear requirements (some knowable in advance – what neighborhoods do we want the new subway line to connect? – And some only knowable during construction – we ran into a watermain when digging this planned subway line, do we want to move the watermain or the line, and if so where?)

The traditional way to solve this issue is to have a competent, fast-turnaround department of planners in city hall who can make good decisions in a reasonable amount of time. This story of how Madrid built an entire subway system in eight years at a ridiculously low budget is amazing and everyone should read it. In principle replacing decisions by specific humans with betting markets should work – the contractor could, when facing a decision like where to put the subway line, make a betting market that pays out if the value of the ConTracked goes up upon that decision being made – but in practice this would be hugely complicated, require massive amounts of liquidity, and would be incredibly difficult to make happen fast. And as the Madrid story tells us, fast turnaround is hugely important (decision lags of months or years commonly kill projects).

(Also, this is all assuming we have a good way to define “completed an adequate subway system” to a decentralized court, which may be possible but definitely isn’t easy).

On reflection, I think the common theme here is that the betting market always has to happen on a decision level abstracted one level above the underlying market. Companies can’t make decisions based on the value of their stock, because the stock has to move faster than the companies do. In an alternate world where companies could make a decision, see how it affected their stock price, and then undo it the stock tanked, the stock wouldn’t tank, because investors would know the company could undo its bad decisions. The stock market requires that companies have a lot of inertia in forming and executing their strategies in order to function. Similarly, setting up a betting market for chess (in either of our forms) required setting the market up to run an order of magnitude faster than the actual game.[5]

And in the infrastructure example, you can’t speed it up by setting up a betting market, because a betting market is, in effect, rival teams of planners fighting (in an efficient way) over who has the best plan. It’ll have to run an order of magnitude slower than any individual team of planners (although in principle the decisions it produces are as good as the best decision by any individual team). Just hiring one of these teams to run your planning department directly is an order of magnitude faster and makes decisions of comparable quality (well, unless you’re New York).

[1] Yes, there’s also a whole bunch of other things things investors trade, like commodities and currencies, but the same principle applies.

[2] Or if Elon Musk tweets the name of an unrelated company with a similar name.

[3] Or if a random subreddit decides to pump up the stock for the 🚀 memes.

How Much Money Do You Need To Start A Bookmakers

[4] Although you might have to ban people from betting in both the White and Black players’ betting markets, since that could create some weird incentives.

[5] Another method of handling chess – if we have a superhuman AI – which for chess, we do – we can just run a betting market on how well it will evaluate each possible move, without looking until after we’ve made it. Again, this requires a higher-level actor in order to work.